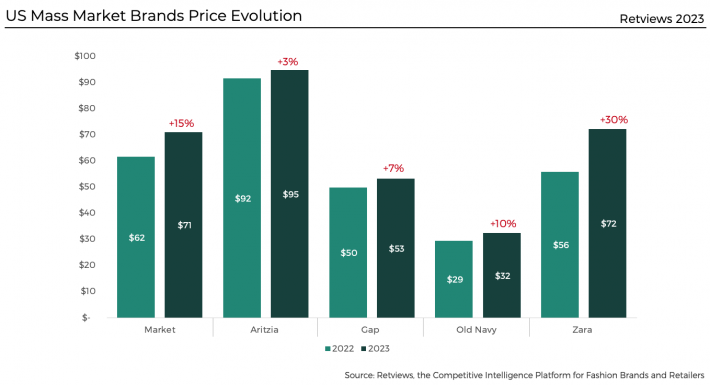

GAP, like many other mass brands, has been forced to adjust its pricing strategy to remain competitive in the market. However, inflation has impacted all players, resulting in a significant increase in the US market’s average price, which has risen by 15% YoY, with Zara experiencing the highest increase in prices, driven by a strategic decision to tap into a more premium sector. Although Zara is inching closer, Aritzia maintains its position as the most expensive mass brand in the US market, with a current average price of $95. By leveraging Retview’s data-driven insights and analytics, brands can optimize their pricing strategies whilst maintaining margins.

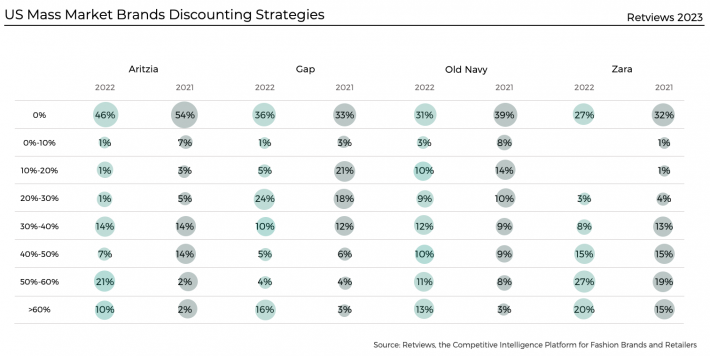

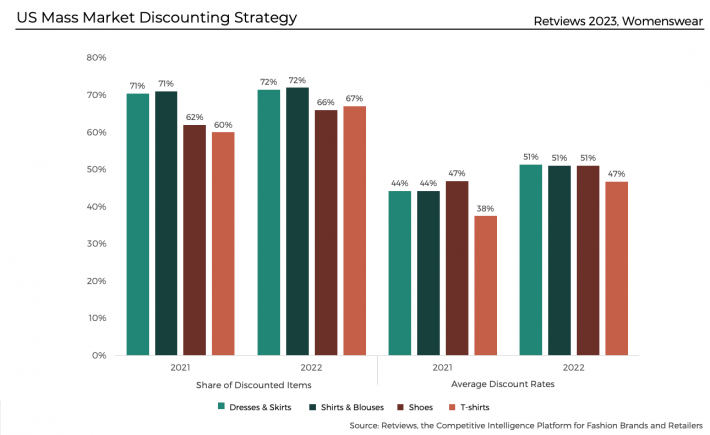

US discounting season

Black Friday is a prominent discount event for both US retailers and consumers, offering an opportunity for retailers to drive sales and for consumers to take advantage of significant discounts on a wide range of products. Retviews data show that the discounting period for Black Friday began earlier than the traditional start date of November 25th in 2022. In fact, as early as mid-November, 44% of the retail assortment was already being offered at discounted prices, representing a 26% increase from the previous year.