Tracking tariff turmoil: data-driven insights on fashion’s response to import tariffs

From absorbing tariff costs to significant price hikes, how are fashion’s leading brands reshaping retail strategies to stay competitive?

Decoding market shifts

Since the US announced new tariffs on imports in April 2025, fashion leaders, have been scrambling to limit the fallout. With price hikes looming, sourcing-heavy brands are already feeling the impact, and fashion leaders have appealed directly to the White House for relief( Vogue Business). Two months in, fashion is no longer in the speculation phase.

Brands are reacting and rethinking their pricing strategies, often on the spot, evaluating if costs can be absorbed or passed on to consumers. With US trade decisions shifting by the week, uncertainty remains the only constant. The result is fluctuating pricing strategies, reassessed assortments, and an urgent need for timely visibility. The first signs of strategic shifts are now visible, and as costs rise and demand softens, merchandisers, buyers and pricing teams need a sharper view of the market in order to quickly rework pricing. From shifting assortment strategies and discounting signals, data-backed decisions are critical to protecting margins and staying competitive.

Dive in as we break down how brands are adapting and how data helps you move with the market, not behind it.

Rethinking international pricing in a tariff market

The tone across the fashion industry has shifted, with brands urgently adapting to protect margins and avoid excess inventory. Those relying on production outside of the US, for example European brands with a strong US presence and popularity, are now hit with higher import taxes and are passing those costs onto consumers.

As a result, optimizing international pricing and market positioning has become essential. Knowing how to tailor pricing strategies by region is key to staying competitive in a volatile market.

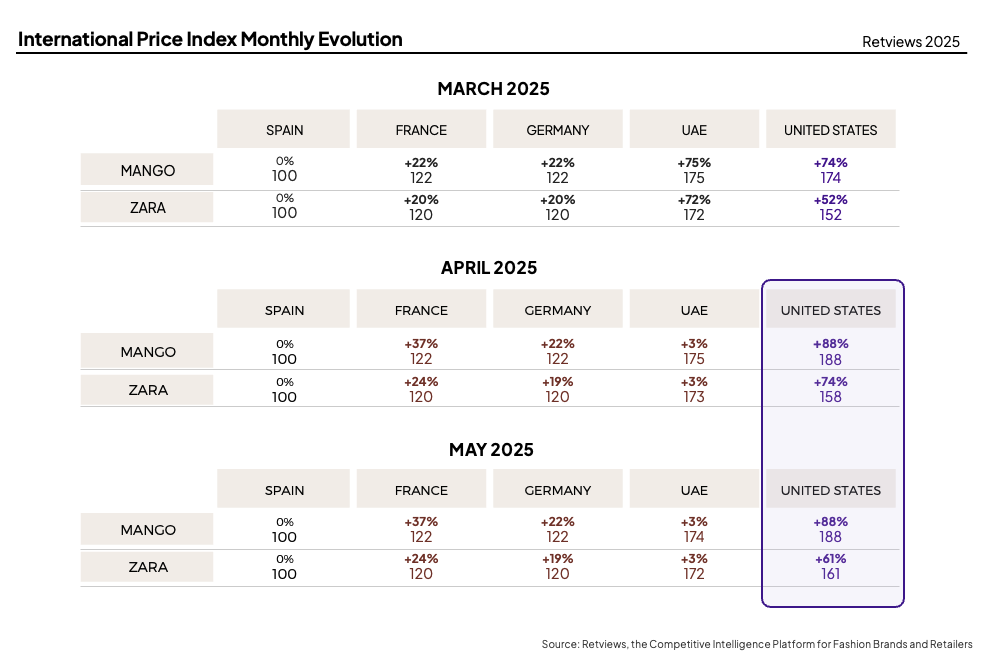

Following the US tariff announcement, Retviews data reveals a clear response from leading mass-market players.

Mango and ZARA raised US prices by 8% and 6%, respectively, despite the US already being one of, if not their priciest market. As of May 31st , Mango’s US assortment is priced 88% higher than in Spain, while ZARA’s sits 61% above its home market.

These increases are not mirrored however, in other key regions such as France, Germany or the UAE, where prices remained unchanged between March and May. While some brands are holding back on widespread price hikes to avoid damaging consumer confidence, the US-specific increases from Mango and ZARA signal a direct response to rising import costs driven by tariffs.

How brands are rebalancing pricing strategies

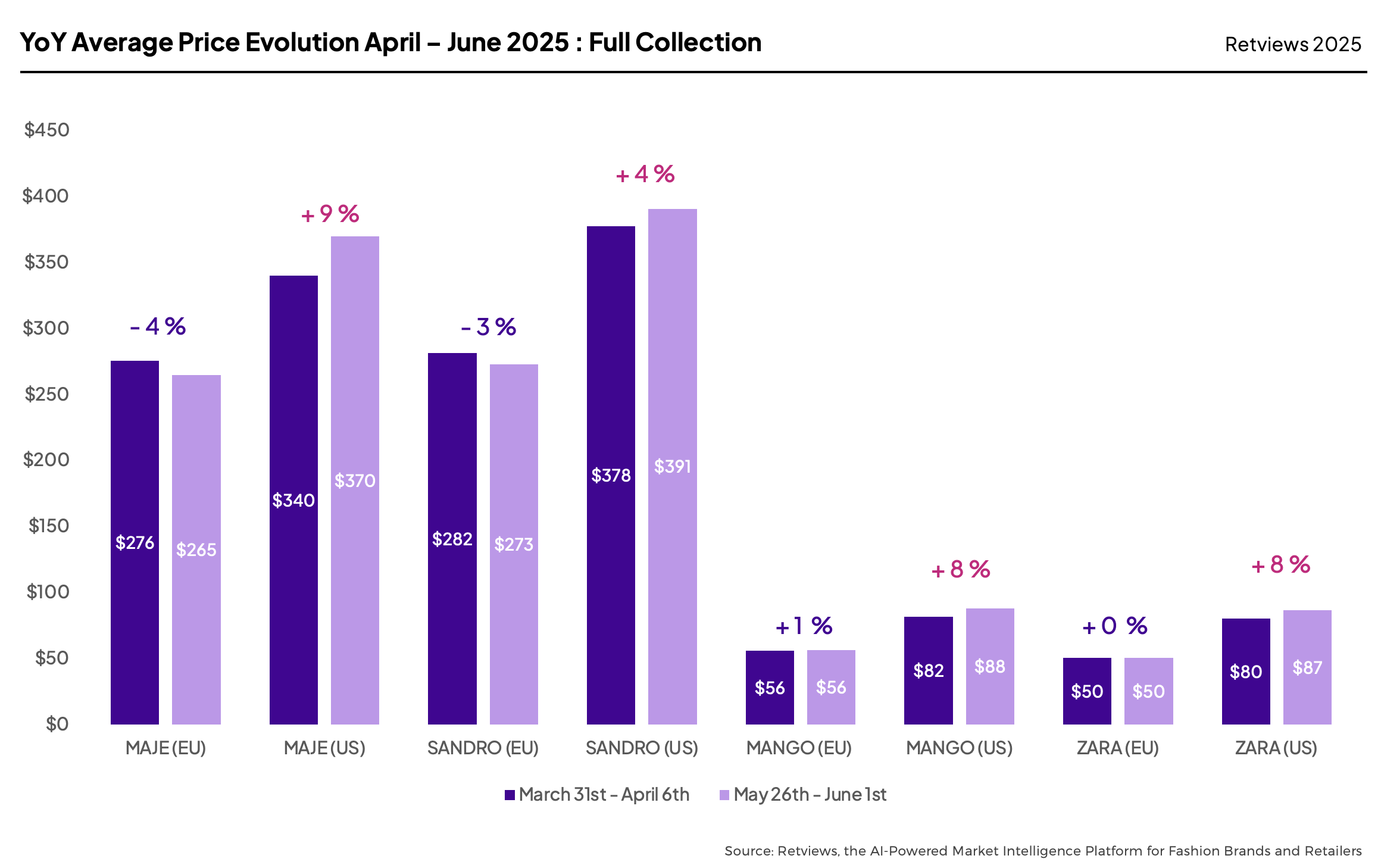

Since the announcement of new US tariffs, brands across both mass and premium segments have begun adjusting their positioning in the market. Although EU-specific tariffs won’t take effect until July, a 10% import duty is already in place (Reuters), fueling uncertainty and volatility. This shifting outlook has already impacted global brands, as Shein has seen slowed momentum in the US under China tariffs, while European brands are suffering losses driven by weakened consumer confidence. While luxury brands may better absorb the shock across different markets, mid-market players are more exposed and must rethink their strategy to protect margins and demand.

Retviews’pricing data reveals significant shifts in US pricing strategy among European mid-market brands between April and early June. While home market prices remain steady, US prices have risen, reflecting a quick strategic reaction to offset growing import costs. Both Mango and ZARA have increased prices in the US market by 8% between March 31st and June 1st, keeping prices steady in the European market. Maje and Sandro however have decreased European prices and have hiked up US prices by 9% and 4%, respectively. The uncertainty surrounding tariff implementation appears to have impacted not only consumer sentiment but also brand decision-making, prompting a cautious yet proactive pricing response.

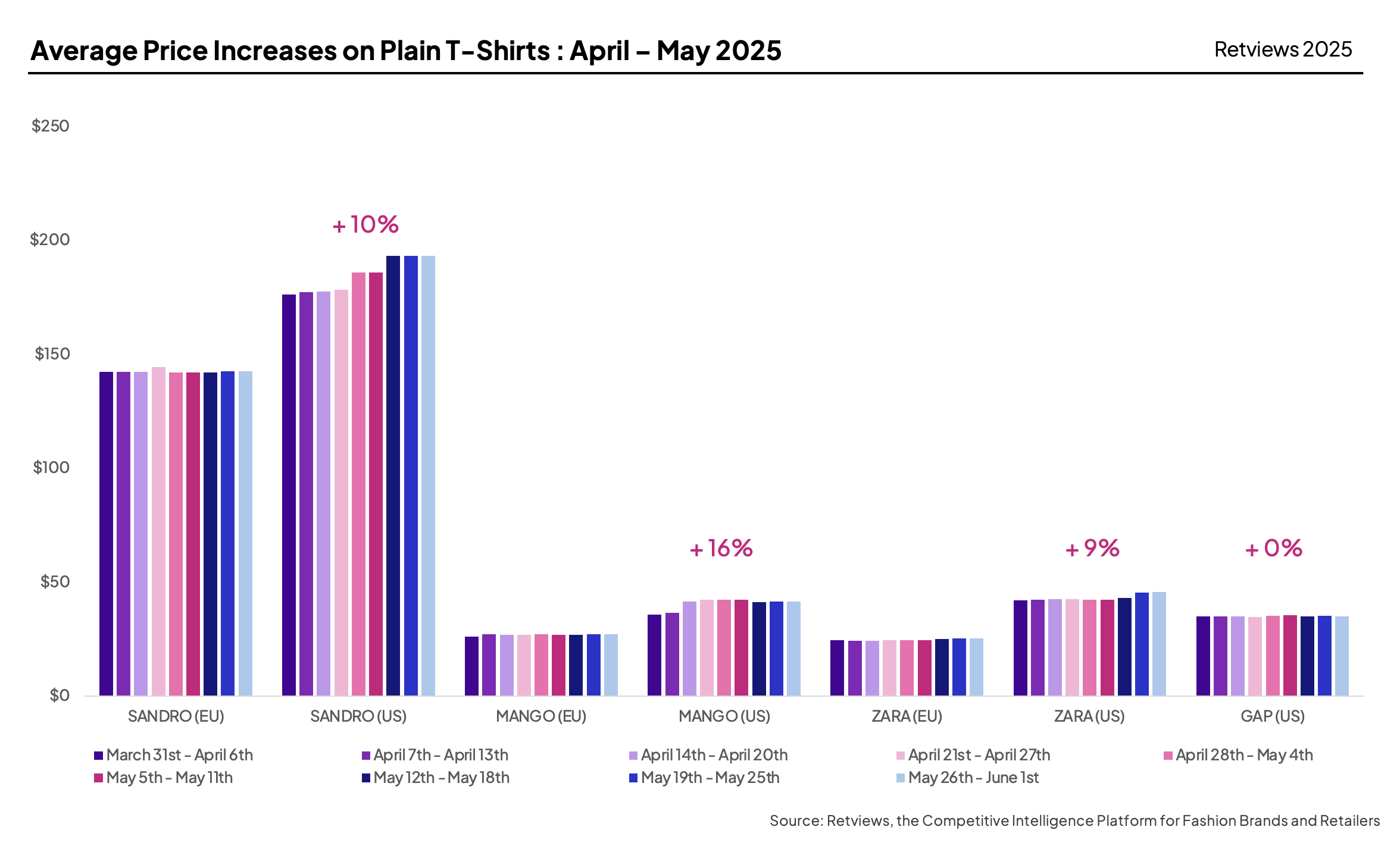

A closer week-by-week look at staple categories, such as plain short-sleeved t-shirts, shows how core, evergreen items are strong identifiers of how brands are adapting their retail strategies. Brands like Sandro, Mango, and ZARA have kept EU prices stable while raising US prices, signaling a deliberate decision to pass costs to consumers. In contrast, GAP, with a recent drop in market share (FashionNetwork), has held prices steady despite market volatility, absorbing short-term costs. The brand is among several others who have decided to not actively pass on costs to consumers just yet (Business of Fashion). With plans to shift to US-grown cotton by 2026 and introducing their premium line, GAP may leverage a stronger “made in the US” positioning to justify future price increases on essential items.

Price reshaping across collections

Since the tariff announcement in early April, fashion brands have been repricing portions of their collections in a strategic push to protect margins. Rather than blanket increases some leading brands are systematically adjusting prices across core categories, whereas others are absorbing costs and not passing them on to consumers, signaling differing responses to rising costs.

From wardrobe staples to trend-driven bestsellers, key product types are being carefully repriced, highlighting where brands see room to absorb cost pressure and where consumers are still willing to pay.

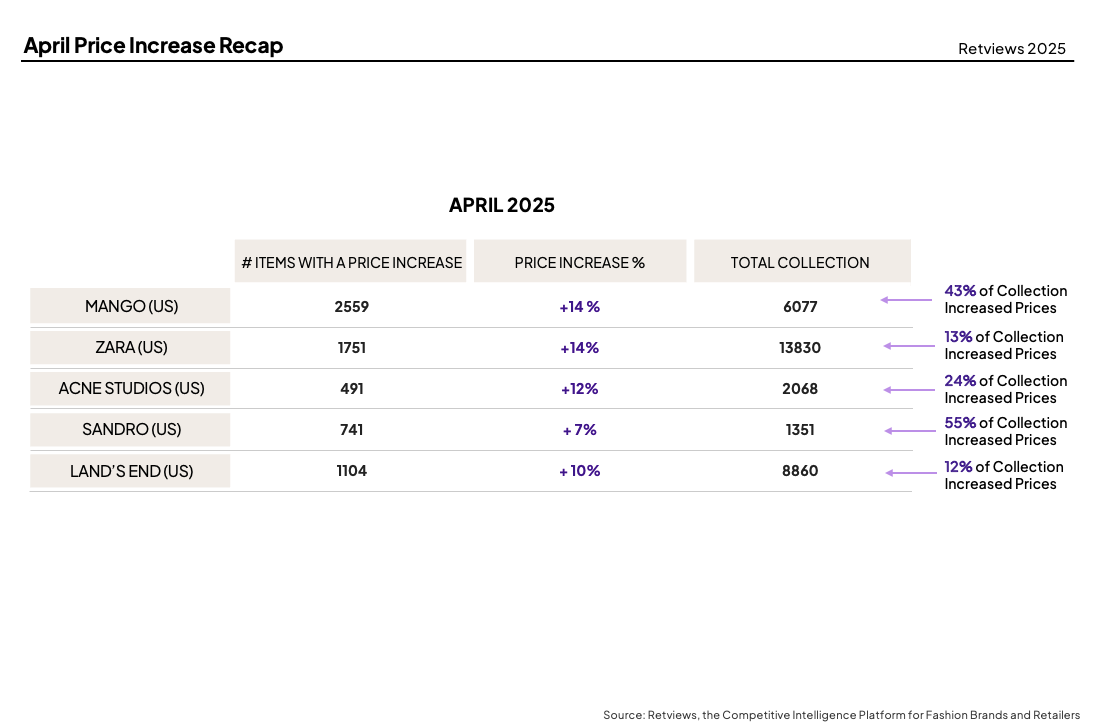

In response to tariff pressure, leading brands are systematically repricing significant portions of their US assortments. In April, ZARA increased prices on 13% of its US collection, with an average 14% hike. The trend continued into May, with 13.5% of the collection repriced again by 14%. By contrast, in France, ZARA raised prices on only three items total across April and May, underscoring a US-specific pricing hike.

Mango implemented even broader changes, increasing prices on 43% of its US collection in April, also by 14%. Sandro followed suit with 7% price hikes across 55% of its US assortment, while Acne Studios raised prices by 12% on 24% of its collection. Among US-based brands, Land’s End raised prices by 10% on 12% of its products in April, suggesting a similar effort to pass rising costs to consumers.

Where prices are rising: category-level shifts in response to tariffs

In optimizing retail strategies, one of the most effective levers is identifying the right pieces to reprice, those with a “trendy” status, strong demand or high visibility, while monitoring how leading players are adjusting their own collections.

Understanding where, when, and by how much competitors are increasing prices can help brands stay competitive and protect margins in a shifting market landscape, as opposed to applying blanket price hikes which could have an adverse effect on both sell-through and excessive discounting.

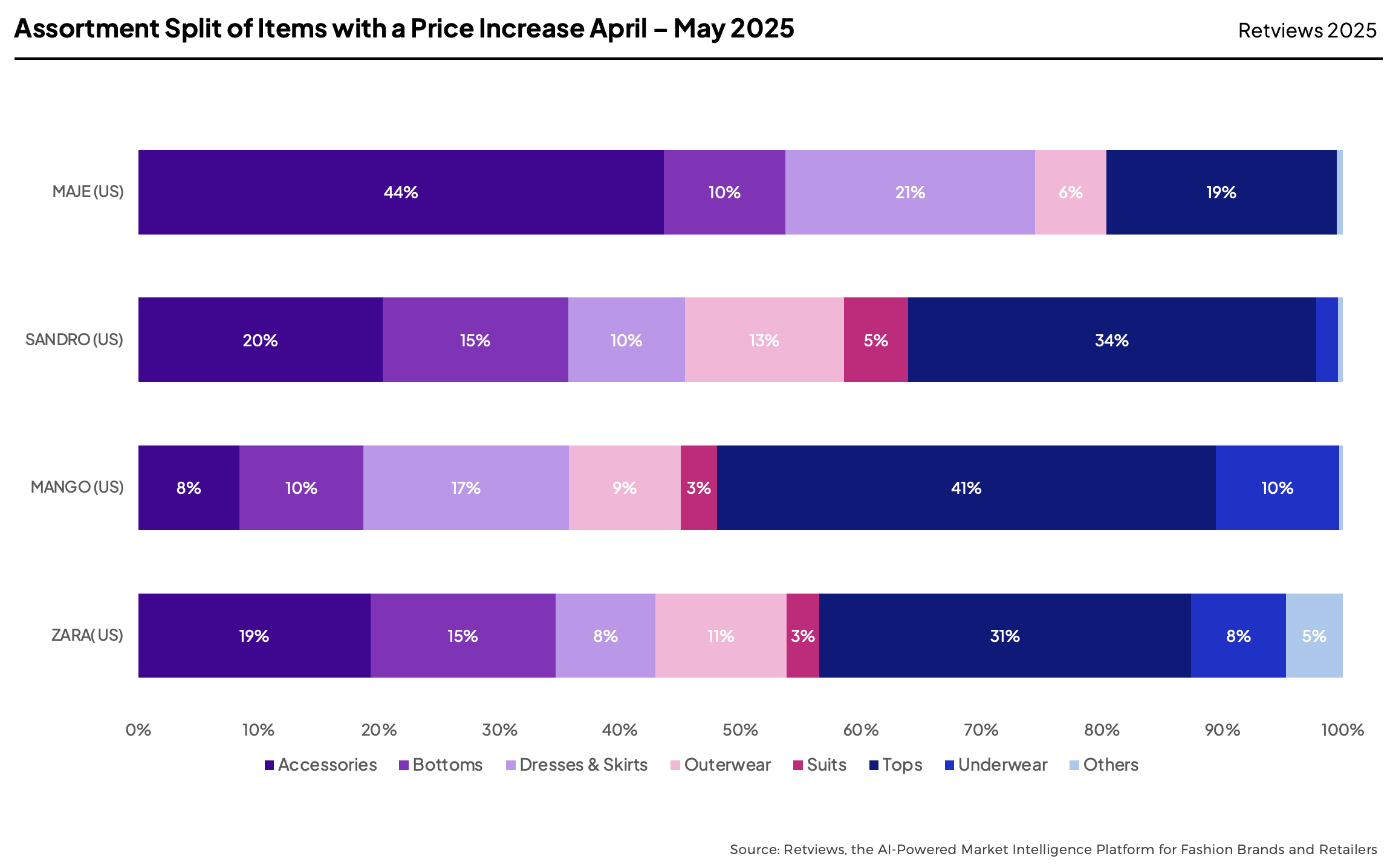

Between April and June, Retviews data shows that leading brands responded to tariff pressures with targeted price hikes in the US market. Tops emerged as the key category for increases across Sandro, Mango, and ZARA, while Maje took a different approach by raising prices on accessories, particularly bags, seasonal footwear and hats.

These decisions reflect strategic prioritization of high-rotation or trend-forward categories that are likely to drive sales during the summer months, to help offset rising costs.

ZARA’s strategy remains heavily focused on apparel, with tops seeing the largest increases. One example is the core short-sleeved t-shirt, part of the brand’s essentials offering, which alone exhibited a price hike of nearly 13% in early May, as the brands passes on costs to US consumers through wardrobe basics, generally having a lower base price point.

One example of Sandro’s price increases is its increase on key fashion-forward items. Its striped polo shirt, tapping into the growing demand for academia-inspired sportswear and echoing the viral success of rugby polos, saw a price increase of nearly 6%. This reflects a calculated move to reprice trend-relevant styles where consumer appetite remains strong.

Turning market volatility into strategic clarity

As US tariff decisions shift from week to week, uncertainty has become the defining force in fashion retail. Brands are no longer waiting, they’re adjusting prices even more frequently than in mid-season, repricing key categories, and reevaluating their international strategy in time.

The volatility isn’t just affecting luxury players who are accustomed to regular price hikes, it’s disrupting mid-market and entry-level brands, forcing merchandisers and buyers to make faster, smarter decisions to protect margins.

With Retviews, merchandisers gain an immediate, data-driven view of how leading brands are adapting, from the share of collections being repriced to specific product categories impacted by tariff-driven hikes. When the market moves fast, Retviews helps you move faster, with the market visibility to respond confidently, stay aligned with shifting consumer expectations, and keep your pricing strategy one step ahead.

Retviews

Latest resources