How fashion brands win Black Friday 2025

Margins over markdowns: outsmarting discount chaos

Managing the Holiday Markdown Season

As we head into the 2025 holiday season, shoppers are entering with more optimism, but still with a sharp eye for value. Both Deloitte’s and PWC’s holiday reports indicate an expected decline in spending YoY. Inflation pressures are stabilizing, yet consumers continue to scrutinize every purchase, prioritizing brands that balance price, quality, and sustainability.

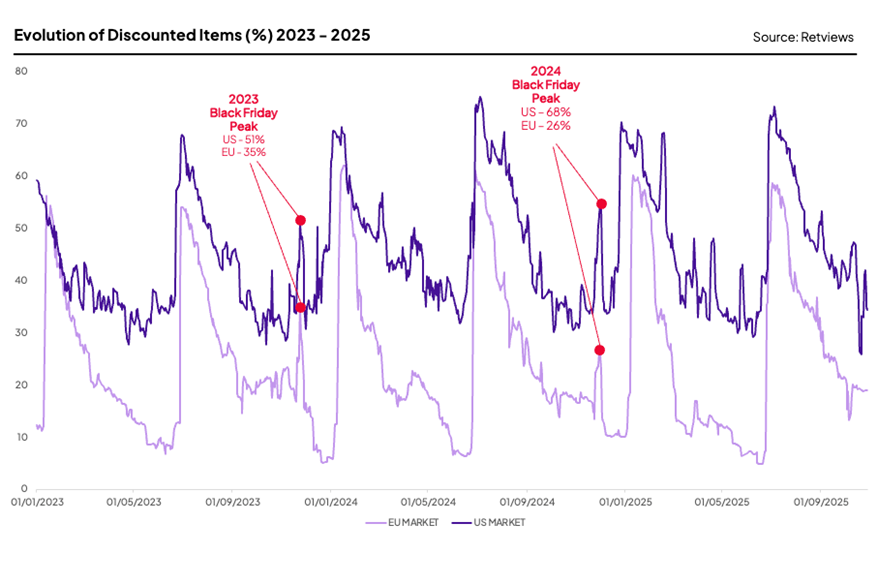

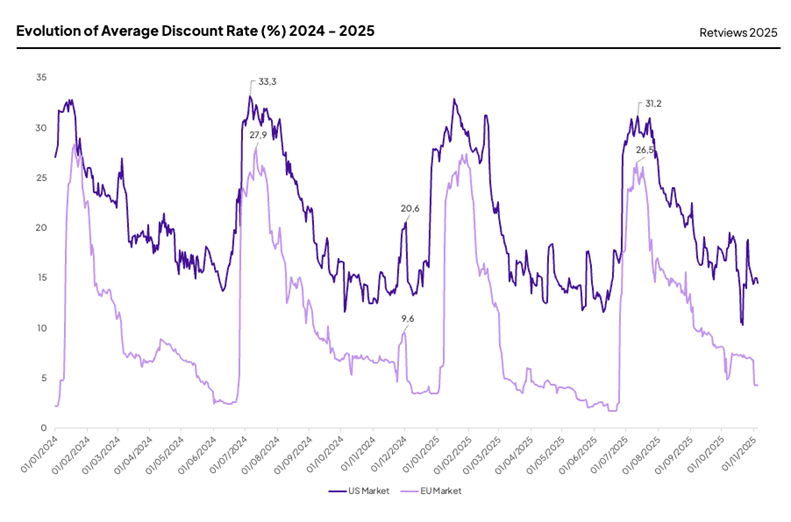

With Black Friday falling on November 28th this year and Cyber Monday on December 1st, the shopping calendar continues to compress. Fashion retailers have a narrow window between seasonal drops and deep discount moments, making the timing of markdowns more crucial than ever, as well as knowing exactly which pieces in your collection to discount to ensure your brand is not risking profit loss this holiday season.

Blanket discounts are no longer an option, and discounts are beginning earlier than ever, as brands try to anticipate competitor moves, but what is the right timing, the right product to discount and the right rate?

Nailing the Early Start to Holiday Discounts

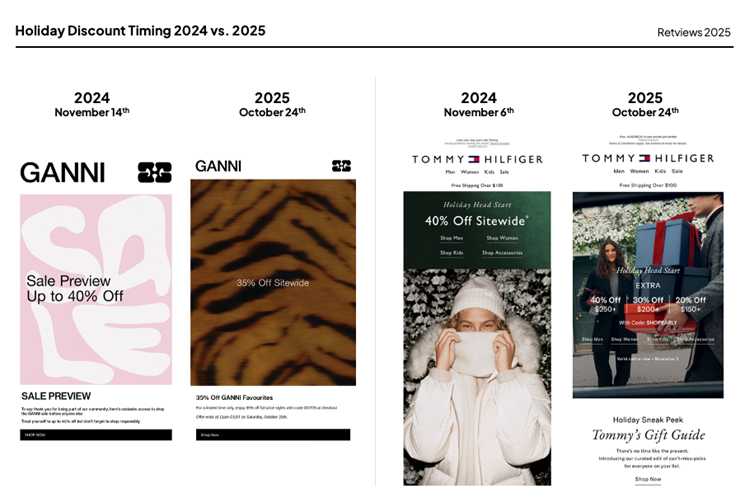

Using Retviews’ data, brand marketing activities show that pre-season discounts are starting earlier in 2025 compared to 2024. Premium brands GANNI and Tommy Hilfiger launched their first major seasonal sales on October 24th, versus November 14th for GANNI and November 6th for Tommy Hilfiger last year. Tommy Hilfiger positions this early event as a “Holiday Head Start,” linking it directly to upcoming seasonal promotions.

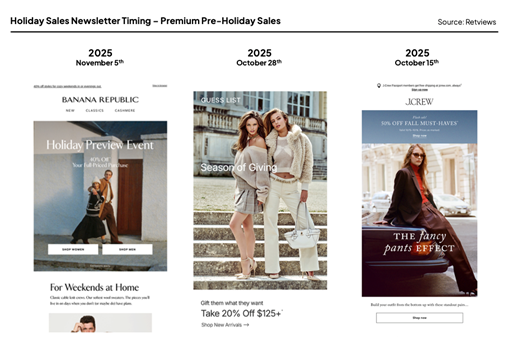

Looking at premium brands, Retviews data shows Banana Republic, GUESS, and J.Crew began holiday discounts in late October and early November, anticipating earlier consumer shopping. Despite early markdowns, these brands continue to highlight new arrivals, with newsletters heavily focused on holiday collections and festive edits.

In contrast, mass-market brands like GAP and Abercrombie & Fitch prioritize discounting, using newsletters to mainly promote promotions throughout the fall season, ahead of the Black Friday and Cyber Monday phenomenon.

What’s Selling? What’s Not?

Looking into the highest rising categories in assortments this fall winter season, Retviews data shows an uptick in four key categories across US and EU markets, accessories; namely wallets and handbags which have increased by 13% and 10% YoY, respectively. When planning a discount season, knowing exactly which categories are trending, is key in identifying which items to sell at full price and which items can be discounted in order to not lose out on profits this discount season. Denim and jackets have also grown in the double digits, up 12% and 14% YoY, respectively.

Retviews data shows that accessories, specifically wallets and handbags, are among the fastest-growing categories this fall/winter, with assortments up 13% and 10% YoY in the US and EU, respectively.

Knowing which categories are trending is crucial when planning discounts as rising items can often hold full price, while slower movers can be strategically marked down to protect profitability.

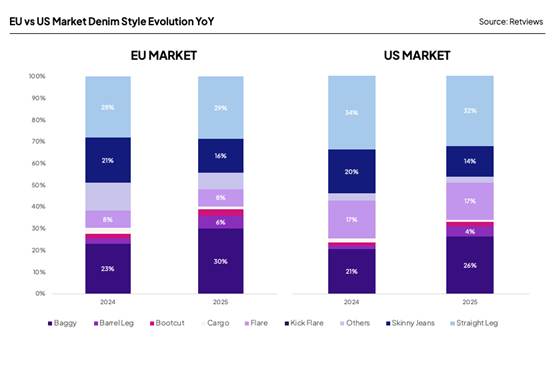

Retviews enables brands to track how assortments and product attributes shift over time across markets. In both the EU and US, denim is seeing a strong resurgence in 2025.

Barrel-leg jeans have doubled in the EU and grown more than 200% in the US compared to 2024. Baggy jeans, which were already a key denim silhouette, continue to rise, up 28% YoY in the US and 30% in the EU.

In contrast, cargo pants are losing momentum, with assortment share falling by 50% in the US and 54% in the EU.

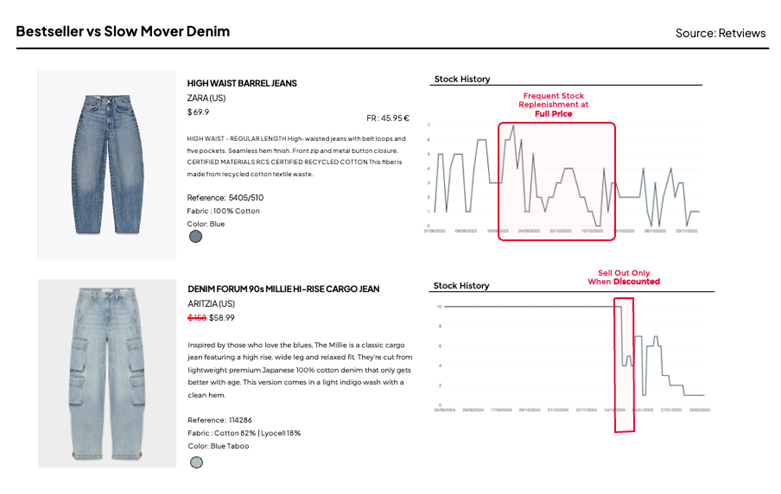

Looking at the two specific styles, Retviews data shows that barrel jeans have solidified their presence as a bestseller in collections, with frequent stock outs and replenishments made at full price, as shown with ZARA’s high waisted barrel jeans.

On the other hand, cargo pants like the Aritzia Millie Hi-Rise Cargo Jean, showcase no stock movement throughout the past months, prior to being discounted. This is a strong indicator for a product being a slow mover in collections which can be discounted in order to clear its stock, whereas a bestselling piece can comfortably be sold at full price and not be discounted in upcoming holiday markdowns.

Leveraging Market Intelligence for Smarter Markdowns

In 2025’s unpredictable retail landscape, marked by cautious spending and intense pricing competition, brands must react faster and more precisely than ever. To protect margins and boost sell-through, retailers need to identify which products are trending and which require markdowns, planning holiday discounts accordingly. Timing is everything today, with brands starting promotions earlier each year, the real challenge is determining when to discount and at what depth to maximize Black Friday performance.

About Retviews

This Black Friday insights report has been delivered with Retviews AI-powered market intelligence.

Thanks to Retviews, merchandisers gain data-backed visibility into how competitors are pricing, discounting, and shifting their assortments throughout the Black Friday period. From tracking the percentage of collections going on markdown to identifying which products and categories are targeted with early promotions, Retviews reveals exactly how the market is moving.

With a close-up view of competitive pricing and sell-through opportunities, merchandisers can make smarter decisions, protect margins on top-performing items, and strategically mark down slower sellers. Stay aligned with evolving consumer expectations, and keep your pricing strategy one step ahead of the market.

AI-powered market intelligence

Latest resources