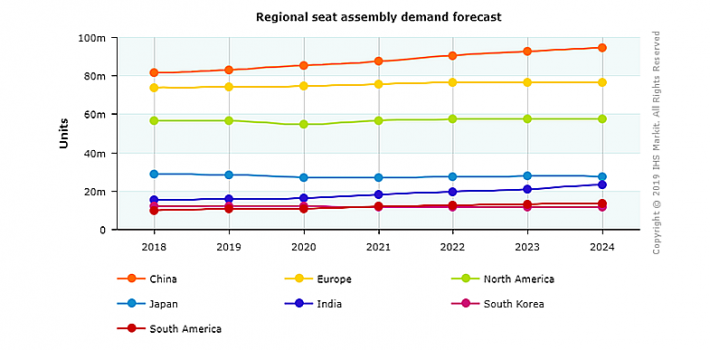

Non-technology-driven rear-row comfort and convenience elements such as enhanced space for the rear bench in terms of legroom, headroom, and shoulder room; and use of fine materials in the form of leather on interior trims and seats, are also finding traction, especially in emerging economies. China has emerged to be one of the leading regions for enhanced rear-row content demand. Owing to heavy traffic and road congestion in the majority of its business cities, China's average consumers are spending a lot of time inside their vehicles. Since most of the consumers are converting the rear rows into workstations, OEMs are given an opportunity to boost vehicle sales by enhancing rear-row content.

With new forms of mobility already gaining traction, especially when it comes to shared-mobility such as cabs and rental services, rear-row content becomes a differentiating factor for the occupants being chauffeured from one location to the other.

Shift toward weight saving in seats and use of new materials

To curb their carbon footprint and adhere to emissions norms, global carmakers have turned to weight saving to offset the effects. The benefit of weight saving also helps the vehicle’s efficiency and performance. Weight saving is not only restricted to the heavy components within a vehicle such as the powertrain, chassis, and so on, it has also become a concern for almost all the vehicle component areas. Seats, as a component, are no exception as automakers look for new measures to reduce weight while adding more content to enhance comfort. In general, standard seats are accountable for about 6% of the total weight of a vehicle. However, seat manufacturers are further investing in lowering seat weight to as minimal as possible.

This achievement will come to fruition with the help of new-age materials. For instance, the use of Advanced High Strength Steel (AHSS) for seat manufacturing can yield weight savings. ArcelorMittal, one of the biggest producers of high-strength steel in the world recently unveiled “S-in motion” steel solutions for front seats to help automakers achieve significant weight reductions by using AHSS. Under the project, the company developed two S-in motion front-seat designs.

The first, called the “Ultimate design,” reduces the seat weight from 12.4 kilograms (kg) to 10.1 kg—a reduction of 2.3 kg or 18.3% per seat. With two front seats, the total savings could be 4.6 kilograms per vehicle. The second solution, called “Efficient design,” reduces the seat weight to 10.4 kg, a saving of 2.0 kg or 15.5% per seat. According to ArcelorMittal, the second solution is achievable at a slightly lower cost to manufacturers. However, both options allow seat makers to achieve a compromise between weight savings and cost without affecting safety.

One effective, yet expensive alternate is by making use of composite material for seat frames such as carbon fiber. For instance, as part of carbon amide metal-based interior structure using a multi-material system approach project, a group of suppliers manufactured seats that are 40% lighter, yet sturdy compared with a traditional metal frame. The new lighter seat makes use of fiberglass-reinforced plastic, nonwoven carbon fiber, and thermoplastic tapes made of carbon filaments.